Discover Forex, Stocks and Crypto trading signals with 79% to 89% accuracy

If you want to receive trading signals - like these in real time - register on the platform and buy the Pro version of LargeTrader.

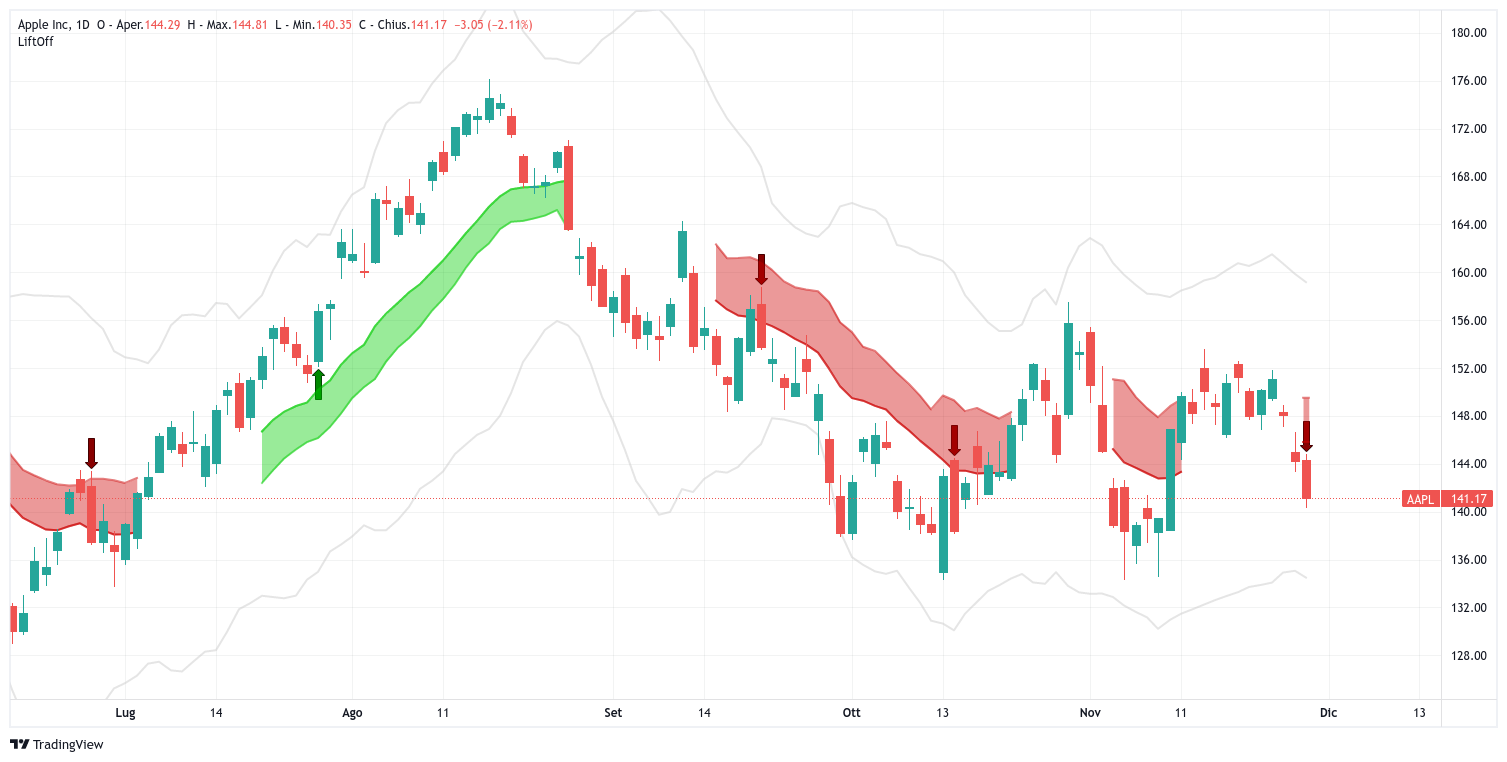

Apple Inc. trading signal - AAPL

US Stock Price Signals and Analysis

Good Morning Traders,

With the close of November 28, Lift-Off proposes a SHORT trading signal on the US stock Apple Inc. (Ticker: AAPL) listed on the NASDAQ and part of the S&P500 Index.

The stock closed at USD 141.17 per share, marking a -2.11%.

The company is operating in the "Electronic Technology" sector particularly in the "Telecommunications Equipment Industry"

The financial robustness data good deteriorating than in the past, the Cash-To-Debt figure is 0.40 the WACC vs ROIC very positive, ROIC very high 33.18%. The financial stress indicators are in very good.

The profitability level figures are very good, the figures compared to the companies in the same industry are among the best even compared to its past. the ROE is very high 160.35%.

The 3-year future projection is up from the current prices.

At this time the price is moderately undervalued relative to the intrinsic value attributed to it, although from our calculations with FCF the price is extremely higher currently.

Year-over-year turnover is growing steadily, except for a decline recorded in 2019, closes 2022 with +7.79% YoY, net income decidedly up and down with double-digit percentage changes. Revenue in Q4'22 is up over Q3'22, and up YoY by +8.14%.

Net income is up 6.58% over Q3'22, and still up slightly YoY with +0.83%.

Debts up sharply in 2022 with a +13.93% YoY increase standing at USD 84.18B with an increase of USD 10.29B

Cash flow (FCF) up YoY in double digits, in 2022 the company recorded a 19.89% YoY increase (111.44B / +18.49B. In Q4'22 it had a sharp increase in FCF over the previous quarter of 20.84B (+48.00M /+0.23%)

Next earnings announcement for Q1 2023:January 26, 2023

Q4 2022 Results

EPS: Reported 1.29 / Expected 1.27 / previous 1.20

Turnover: Reported 90.15B / Expected 88.74B / previous 82.96B

Below chart of Apple Inc. - AAPL - with the signal detected by Lift-Off

Some information about Apple Inc.

Apple Incdesigns, manufactures and markets smartphones, personal computers, tablets, wearable devices and accessories worldwide. It also sells various related services.

In addition, the company offers iPhones, a line of smartphones; Macs, a line of personal computers; iPads, a line of multi-purpose tablets; AirPods Max, an over-ear wireless headphone; and wearables, home and accessories that include AirPods, Apple TV, Apple Watch, Beats products, HomePods and iPod touches.

In addition, it provides AppleCare support services; cloud services storage services; and operates various platforms, including the App Store, that allow customers to discover and download apps and digital content, such as books, music, videos, games, and podcasts.

The company offers various services, such as Apple Arcade, a subscription-based games service; Apple Music, which offers users a curated listening experience with on-demand radio stations; Apple News, a subscription-based news and magazine service; Apple TV, which offers exclusive original content; Apple Card, a co-branded credit card; and Apple Pay, a cashless payment service, as well as licensing its intellectual property.

In addition, it serves consumers and small and medium-sized businesses; and education, business, and government markets. It distributes third-party applications for its products through the App Store.

It also sells its products through its retail and online stores and direct sales force; and third-party cellular network operators, wholesalers, retailers and resellers. Apple Inc. was incorporated in 1977 and is headquartered in Cupertino, California.

Financial Overview: AAPL's current market capitalization is US$2,294T. The company's TTM EPS is USD 6.14, dividend yield is 0.64% and PE is 24.27. Apple Inc's next earnings release date is Jan. 26. The estimate is US$2.04.

Accounts, including revenue, expenses, profit and loss: AAPL's total revenue for the latest quarter is US$90.15B, up 8.66% from the previous quarter. Net income in Q4 22 is 20.72B USD.

Overview data and accounts source: Tradingview.com

Signal sheet as of Nov. 30, 2022

SHORT- Apple Inc. - AAPL

Input price: $141.17 USD (and any opening price)