Discover Forex, Stocks and Crypto trading signals with 79% to 89% accuracy

If you want to receive trading signals - like these in real time - register on the platform and buy the Pro version of LargeTrader.

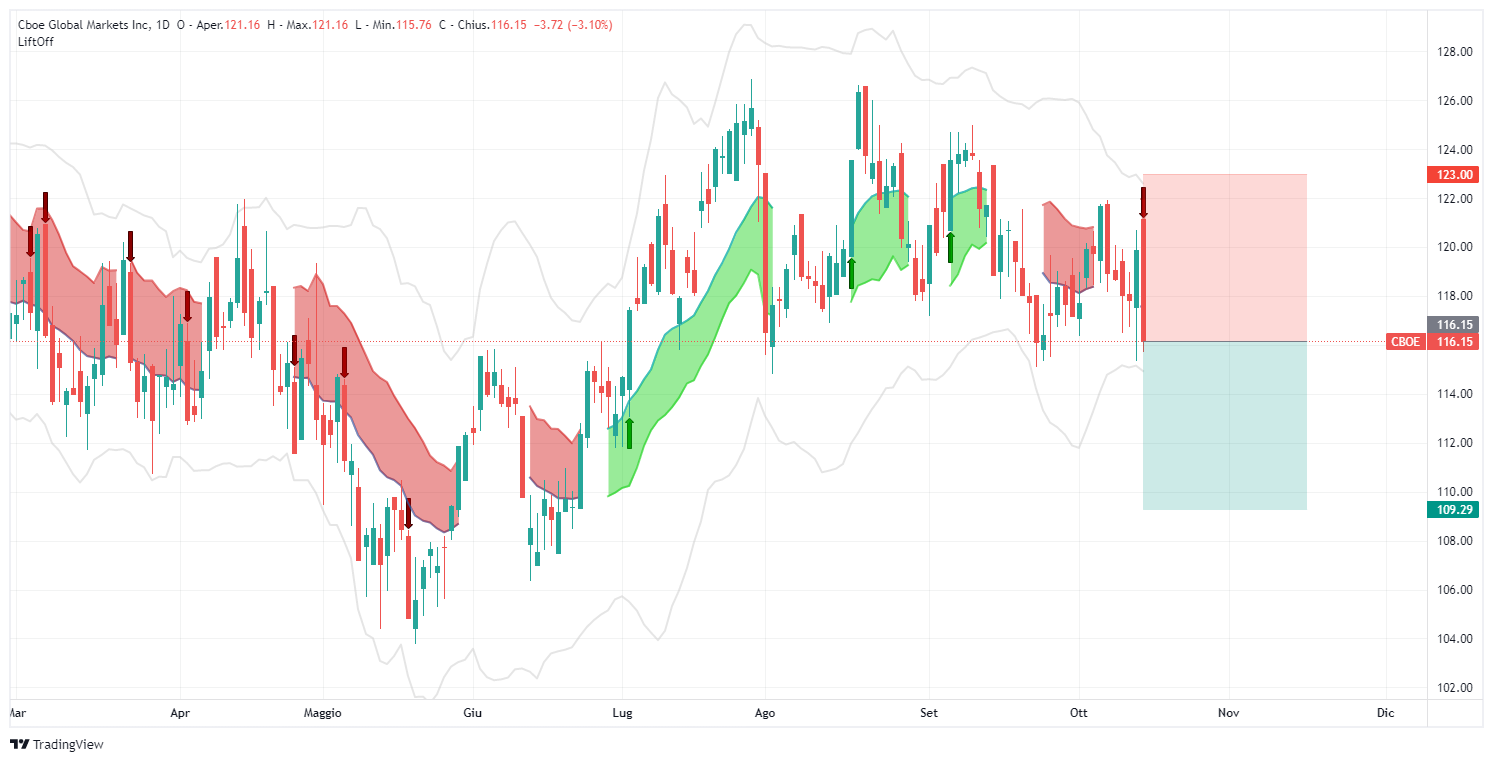

Cboe Global Markets Inc - CBOE trading signal

US Stock Price Signals and Analysis

Good Morning Traders,

With the close on Friday, October 14, Lift-Off offers a SHORT trading signal on the US stock Cboe Global Markets Inc (Ticker: CBOE) listed on BATS and part of the S&P500 Index.

The stock closed at $116.15 per share, marking a -3.10%.

The company operates in the "Finance" sector specifically in the "Broker/Investment Banking Industry."

Financial robustness data are sufficient, Cash-To-Debt figure of 0.21 (so the company is indebted), WACC vs ROIC is good and financial stress indicators are slightly negative.

The profitability level figures are high because the 10-year forecast is very good, the figures are negative compared to its history, but example has a low ROE % and more.

The future projection is slightly downward for the next 3 years.

Right now the price is overvalued compared to the intrinsic value attributed to it, for example it has a PE Ratio of 59.85 (very high)

Year-on-year sales are increasing strongly and also the net income, which however with the latest reading of Q2'22 goes negative marking a -275% on the previous figure of Q1'22

Debts, however in very strong increase year-on-year from 2017, before this date the company had no debts. Liquidity manages to grow year-on-year after the low in 2016.

Next earnings announcement for Q3 2022: October 28, 2022 - watch out for earnings (earnings)

Below chart of Cboe Global Markets Inc - CBOE - with signal detected by Lift-Off

Some information Cboe Global Markets Inc

Cboe Global Markets Inc is committed to providing trading and investment solutions to investors.

It is engaged in Options which includes the options trading business, listing options trading on market indices (index options) as well as multiple listed non-exclusive options, North American Equities, covering listed equities and ETP transaction services occurring on BZX, BYX, EDGX and EDGA, Futures which includes the futures exchange business, CFE, which includes the offering for trading futures on the VIX index and bitcoin and other futures products, European Equities refers to the transaction services of European listed equities, ETPs, exchange-traded commodities, and international certificates of deposit occurring on the RIE, managed by Cboe Europe Equities, and finally manages Global FX which represents institutional FX trading services occurring on the Cboe FX platform.

The company was founded in 1973 and is headquartered in Chicago, IL.

Financial Overview: CBOE's current market capitalization is USD 12,315B. The company's TTM EPS is 1.96 USD, dividend yield is 1.72% and PE is 61.52. The next earnings release date for Cboe Global Markets, Inc is November 4. The estimate is US$1.65.

Accounts, including revenue, expenses, profit and loss: CBOE's total revenue for the latest quarter is US$985.80M, up 1.16% from the previous quarter. Net income in Q2 22 is -184.50M USD.

Overview data and accounts source: Tradingview.com

Signal board October 17, 2022

SHORT - Cboe Global Markets Inc - CBOE

Input price: $116.15 (and any opening price)

Price stop loss or adjustment zone: $123.00

Price take profit zone 1: $109.30

Price take profit zone 1: $109.30

.