Discover Forex, Stocks and Crypto trading signals with 79% to 89% accuracy

If you want to receive trading signals - like these in real time - register on the platform and buy the Pro version of LargeTrader.

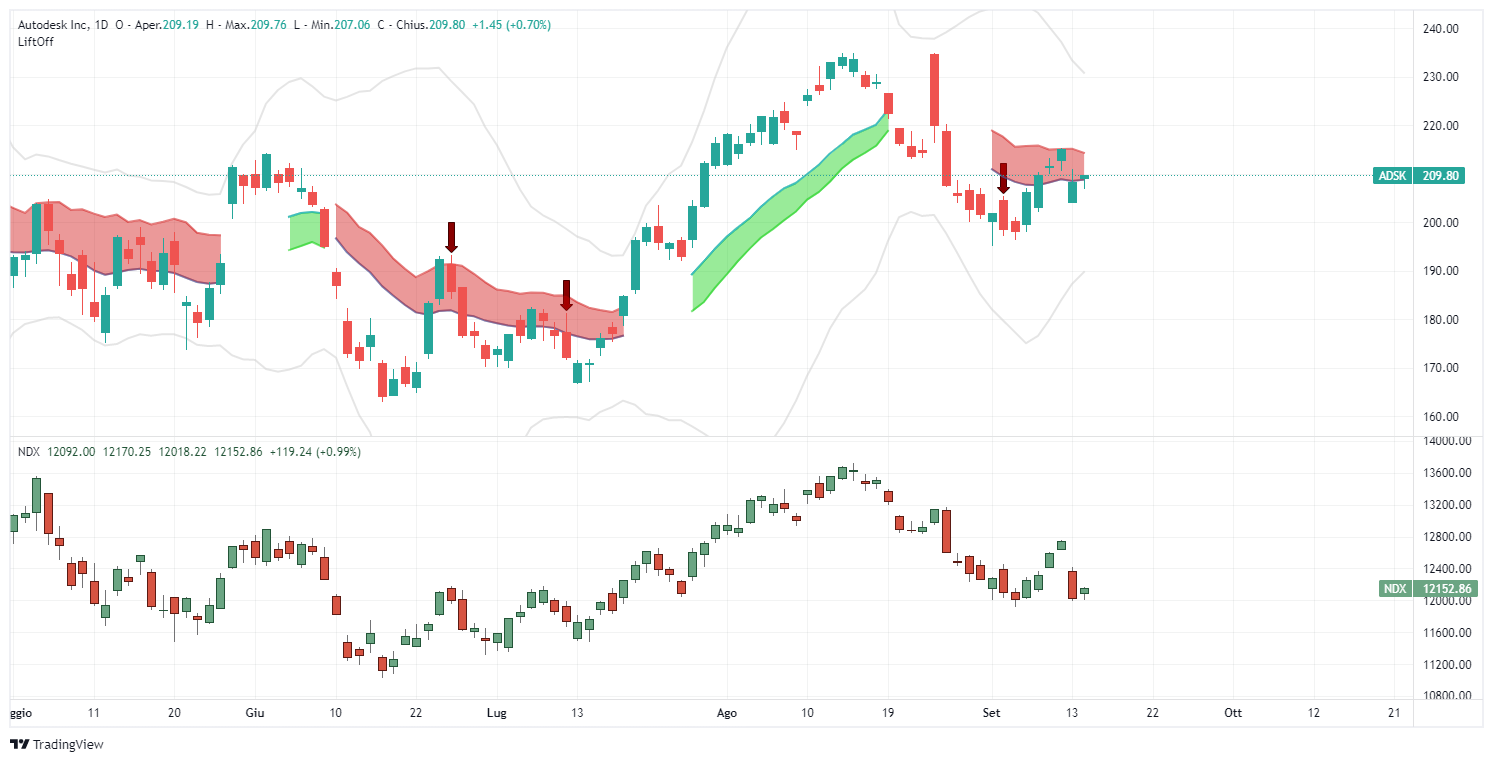

SHORT Adjustment Autodesk Inc.- ADSK

US stock price signals and analysis

Good morning Traders,

For educational purposes, let's see how we could have handled the September 5 SHORT trade on Autodesk.

Below we see the signal

Following the rise of the S&P500 and NASDAQ index, which brings Autodesk back above the high that generated the signal, we could prepare for an adjustment of the inserted stop loss, increasing the distance from the entry, doubling it,,, but without increasing the total risk, closing at a loss half of the position after the volatility long, waiting for the important news of the CPI.

Below chart with Autodesk above and below the NASDAQ index

Currently the position would still be in the market, with the same risk as initially expected, and the loss taken can be recovered with little market movement.

We see that yesterday the NASDAQ made a descent of more than 4 percentage points, the largest decline since 2020, while ADSK remains behind, but with high probability that it will follow the market.

Should ADSK continue its ascent instead, the loss will be as initially decided.