Discover Forex, Stocks and Crypto trading signals with 79% to 89% accuracy

If you want to receive trading signals - like these in real time - register on the platform and buy the Pro version of LargeTrader.

Trading Signal The AES Corp - AES

US Stock Price Signals and Analysis

Good Morning Traders,

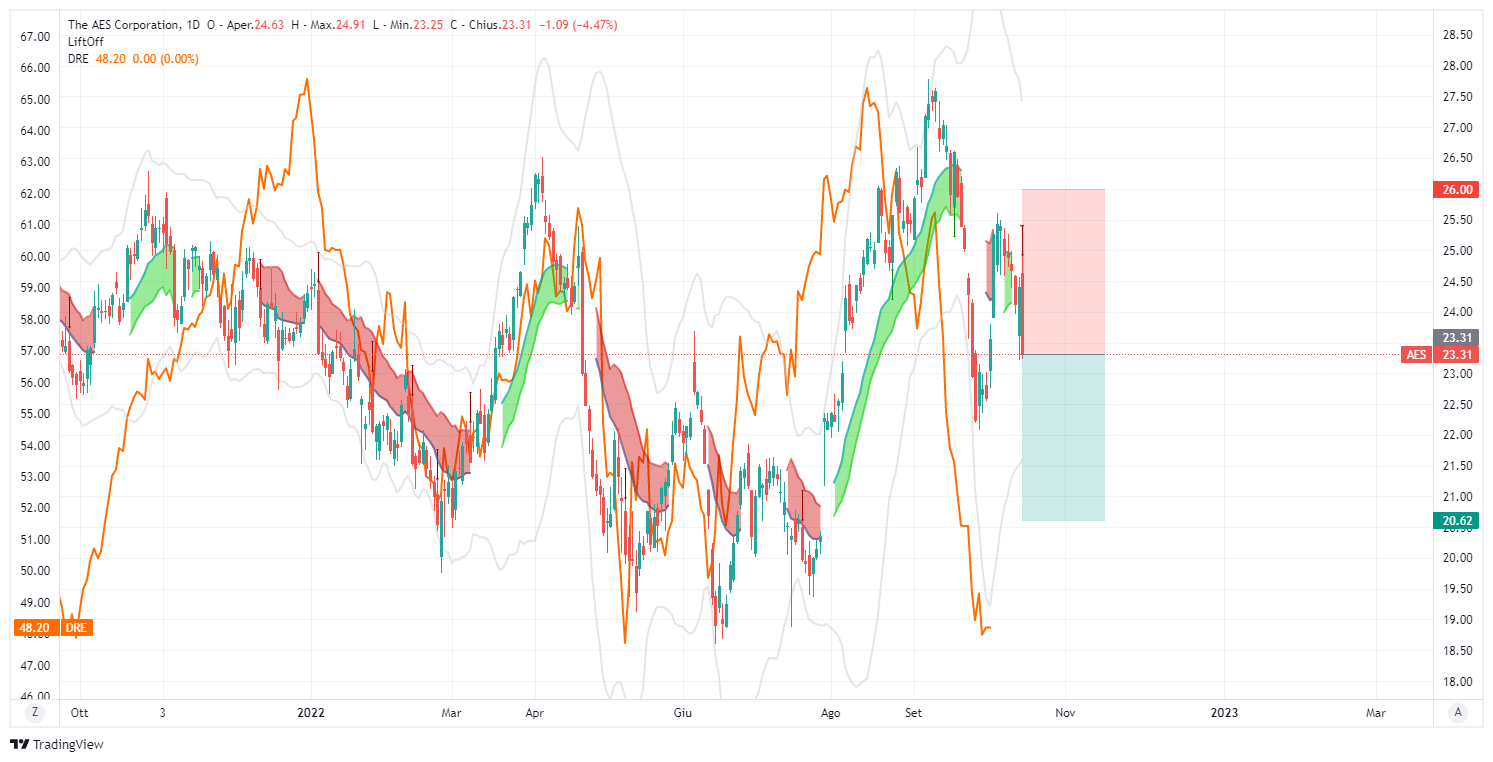

With the close on Friday, October 14, Lift-Off offers a SHORT trading signal on the US stock The AES Corp (Ticker: AES) listed on the NYSE and part of the S&P500 Index.

The stock closed at $23.31 per share, marking -4.47%.

The company is operating in the "Utilities" sector particularly in the "Power Plant Industry."

Financial robustness data is very poor, Cash-To-Debt figure of 0.08, WACC vs ROIC is good, but financial stress indicators are not good.

The profitability level data is barely sufficient, with negated data compared to industries in the same sector and also and its history, example has negative ROE % and not only.

Future growth projection is slightly upward for the next 3 years.

Right now the price appears to be at the right price compared to the intrinsic value attributed to it.

Year-on-year sales have been declining for many years, negative net income in 2021 and in Q2'22.

Debt in stable year-over-year, but rising in recent quarters, while liquidity shrinks year-over-year.

Next earnings announcement for Q3 2022: 04 November 2022

Below chart of The AES Corp - AES - with signal detected by Lift-Off

Below chart of The AES Corp - AES - in comparison with DUK - orange line - (sign DUK)

DUK is operating in the same sector as AES which is currently far behind the movement of the competitor, so we can expect a descent by The AES corp.

Some information The AES Corp

The AES Corp engages in the provision of power generation and utility services through its thermal and renewable generation facilities and distribution businesses. It operates through US and Utilities Strategic Business Unit (SBU), South America SBU, MCAC SBU, and Eurasia SBU. The US and Utilities SBU segment consists of facilities in the United States, Puerto Rico, and El Salvador.

South America SBU covers Chile, Colombia, Argentina, and Brazil, MCAC SBU refers to Mexico, Central America, and the Caribbean. and Eurasia SBU manages operations in Europe and Asia. The company was founded by Dennis W. Bakke and Roger W. Sant in 1981 and is headquartered in Arlington, VA.

Financial Overview: AES's current market capitalization is US$15.57B. The next earnings release date for The AES Corporation is November 3. The estimate is $0.52 USD.

Accounts, including revenue, expenses, profit and loss:AES's total revenue for the latest quarter is $3.08B USD, up 7.89% from the previous quarter. Net income in Q2 22 is -179.00M USD.

Overview data and accounts source: Tradingview.com

Signal board October 17, 2022

SHORT - The AES Corp - AES

Input price: $23.31 (and any opening price)

Price stop loss or adjustment zone: $26.00

Price take profit zone 1: $20.60

Price take profit zone 1: $20.60

.